How It Works

Apperentily deducted upto 100%

Deducted 20% now

Standard 5-year Schedule

Green Incentives & Credits

Quick Summary

We understand purchases like Ekocopter especially in this current farming cycle, which may require financing. We will work with you to access micro, business, agricultural specific loans, REA (rural energy for America), EQIP (environmental quality incentives programs), including lending companies financing alternatives.

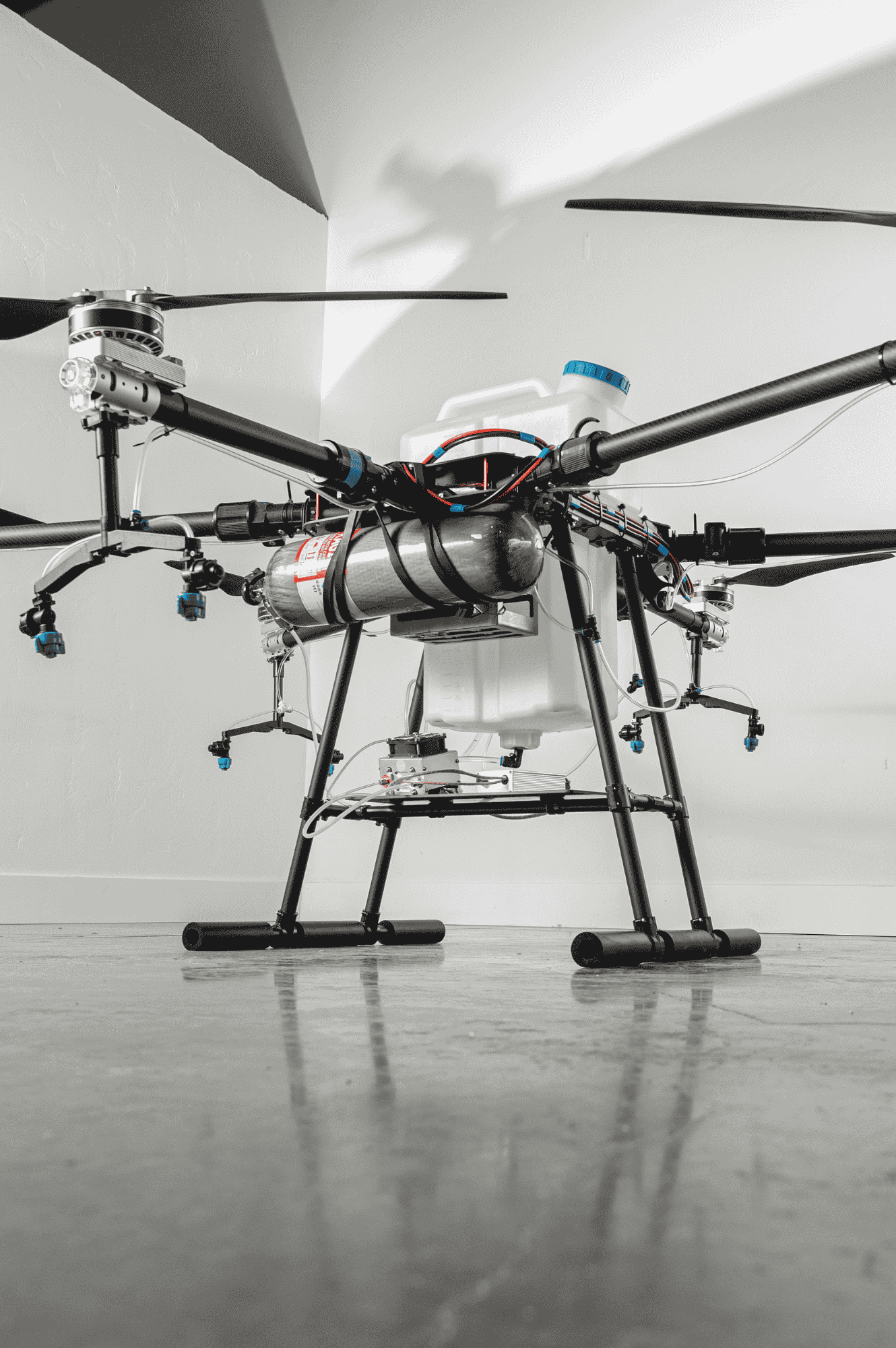

Reserve your UAS Green Sprayer now for just $1,000 and lock in this exclusive price.

A $1,000 pre-sale deposit, lock in your Ekocopter HLS 1000 UAS Sprayer at the guaranteed price protection of $19,600, with exclusive bundled offer, exclusive pre-sale reservation is limited to 900 fulfillment orders on first come first serve bases, pre-sale reservation is open until February 16, 2026. With first batch of deliveries scheduled for October 15, 2026.